Islamic Products

Islamic Mortgage Guarantee Programme (MGP-𝙞 )

What is MGP-𝙞 ?

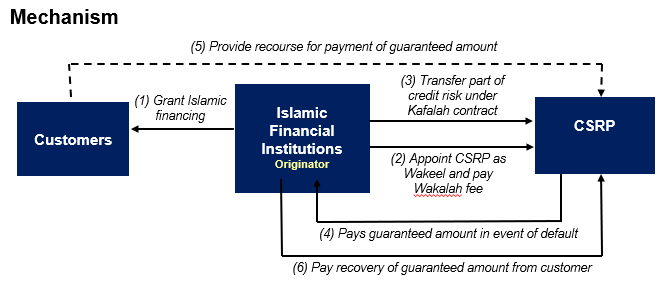

- It is a programme that provides guarantee on the Islamic house financing granted by an Islamic Financial Institutions (IFI) to its Customers.

- It is undertaken by Cagamas SRP Berhad (CSRP), a wholly owned subsidiary of Cagamas Holdings Berhad that offers ‘first loss’ protection on an Islamic mortgage portfolio while the Islamic mortgage assets remain on the IFI’s books

- The programme is formulated under Shariah principle of Kafalah and Wakalah

Product Features

- Product Description

- CSRP will provide ‘first loss’ protection to mortgage originators in Malaysia on a portfolio basis.

- No individual financing can be taken out from the mortgage portfolio under protection other than, amongst others, in the case of redemption/prepayment in full or amortisation, which results in the outstanding principal balance falling below the protection threshold amount.

- Eligible Financing Type

- Standardised and centralised guarantee programme offered to banks for Islamic mortgage financing.

- Islamic residential mortgage financing complying with the standard Eligibility Criteria (EC).

- Guarantee Coverage

- Current financing-to-value (FTV) ratio of the mortgaged property as at the guarantee date is not more than 95%.

- Initial guarantee amount is the difference between the current financing amount and the protection threshold amount (e.g., 79.9% of mortgaged property value as at the guarantee ate).

- The guarantee amount will reduce in accordance with the individual financing amortisation schedule which will be determined at the guarantee date.

- The guarantee amount is the difference between the “scheduled” outstanding principal balance and the protection threshold.

- Termination of Protection

Protection will be terminated upon:

- The “scheduled “ outstanding principal balance of the financing falls below the protection threshold amount (e.g., 79.9% of the property value as at Guarantee Date) by way of payment/prepayment in full or financing amortisation.

- Non-compliance with representation, warranty and eligibility criteria.

- Payment of guarantee amount by CSRP to the originator.

- Guarantee fee

- No guarantee fee for Islamic mortgage financing.

- Wakalah Fee

- This fee is applicable for MGP-i.

- Wakalah fee is either a one-off payment for the entire protection tenure or on an annual fee basis paid by the Originator.

- Eligibility Criteria

- Financing Terms

- Maximum outstanding principal balance as at the guarantee date

- Landed property: RM2 million

- Non-landed property: RM0.7 million - Maximum current financing-to-value ratio as at the guarantee date is 95%

- Remaining financing tenure as at the guarantee date must not exceed 30 years

- Minimum 12 month seasoning

- No past due over 1 month and no restructuring agreement in the 6-month period prior to the guarantee date

- The financing is a term financing which fully amortised over the financing period. Financing with profit-only payment structure is not eligible

- The financing is for the purchase or refinancing of a completed residential unit or for renovation of a residential unit

- Maximum outstanding principal balance as at the guarantee date

- Customers

- Maximum debt-to-income ratio is 50% including all debts and based on gross approach calculation.

- Full documentation is required for Income Proof

- Property

- Must be residential and completed property

- The Mortgaged Property must be owner occupied

- The Mortgaged Property must have fire takaful coverage. Inclusion of additional perils in the fire takaful to cover for other serious damage is encouraged.

- Legal Title and Documentation

- The Originator must have title to the Mortgaged Property free from other encumbrances

- Financing Terms

Benefits

- Transfers credit risk

- Capital relief is based on BNM Risk Weighted Capital Adequacy Framework

- Facilitates management of portfolio concentration risk

- Improves Return on Risk Weighted Capital

- Improves earning stability

- Limits credit exposure to an acceptable level

- Mortgage assets remain on the balance sheet