Purchase With Recourse (PWR)

What is Purchase With Recourse (PWR)?

- Approved Seller (AS) sells loans to Cagamas with an option, at the maturity of the contract, to repurchase the pool of loans sold or execute a new contract for a further contracted review period based on new terms.

- The loans are purchased at their book value, i.e., purchase at par value based on previous month end balance.

- At end of tenure, loans to be repurchased by the AS at the estimated amortised value of the loans.

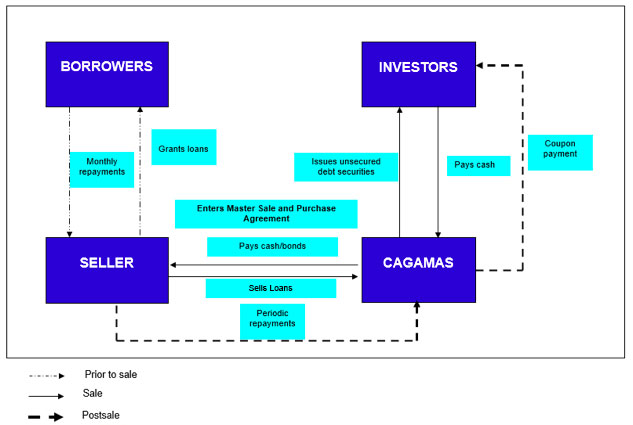

Overview of PWR

Product Features

- Purchase Price: Principal balance outstanding as at the purchase date

- Rate Type: Fixed / Floating / Convertible

- Instalment Frequency: Monthly / Quarterly / Semi-Annually / Annually

- Repurchase: Repurchase of defective loans on quarterly intervals

- Replacement: Replacement of repurchased loans by way of sale of new loans of a value which is equivalent to the repurchased value

- Rollover Option: At maturity, the AS will be given an option to repurchase the pool of loans sold to Cagamas or execute a new contract for a further contracted review period based on new terms.

Benefits of PWR

- Competitive pricing to the AS by tapping the capital market through Cagamas bonds which are rated AAA.

- Avenue to raise funds at fixed/floating rates (hedging against rising interest rates).

- Diversify funding resources.

- No fee and transaction cost to the AS.

- Fast turnaround time.

- Loans remain on the book of the AS to maintain the asset growth.