Purchase Without Recourse (PWOR)

What is Purchase Without Recourse (PWOR)?

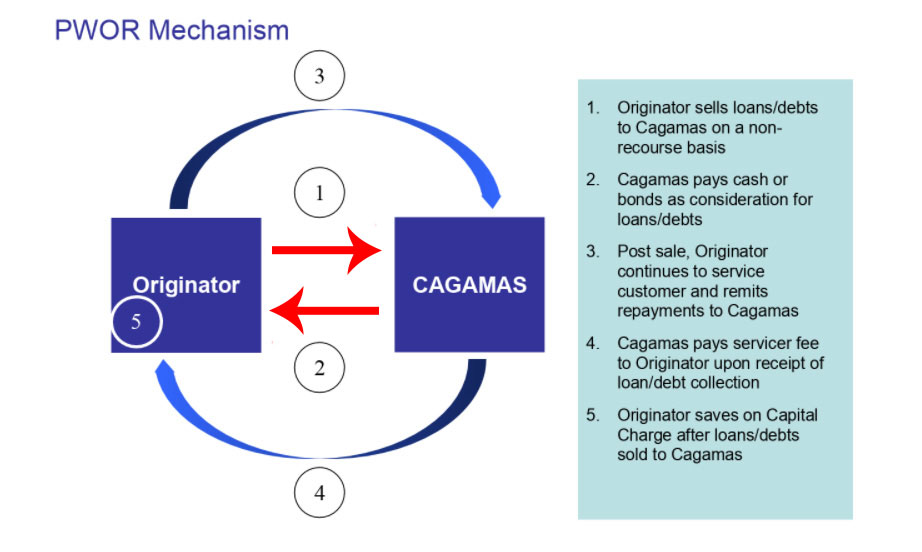

- Cagamas purchases conventional loans on a without recourse basis, i.e., Cagamas does not have any recourse to the seller institution and assumes the full credit risk of the customer.

- The seller institution receives proceeds from the sale of the loans up-front and receives a servicer fee as the appointed servicer for servicing and administering such loans on behalf of Cagamas.

Key Features of PWOR

- Outright sale to Cagamas, no recourse for default risk

- Islamic and conventional transaction

- Standardized structure and documentation

- Pricing depending on quality of assets

- Cash purchase and/or settlement by way of issuance of Cagamas bonds to the seller institution

- Seller institution will be paid a servicer fee on a fixed periodic basis post purchase for the services rendered

- Seller institution will be appointed as servicer for loans sold – customer(s) not affected

Benefits of PWOR

- Transfer of credit risk

- Full capital relief

- Management of portfolio concentration risk

- Shift to fee-based income

- Improves Return on Asset / Return on Risk Weighted Capital

- Improves earning stability

- Savings on rating, legal SPV and advisory fees

- Flexible transaction size

- Does not require large transaction size to achieve economies of scale as in the case of Asset-Backed Securities