Purchase Without Recourse-𝙞 (PWOR-𝙞 )

What is PWOR-𝙞

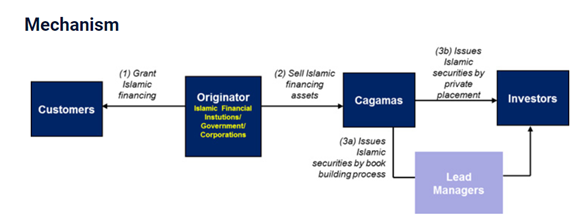

A transaction whereby Cagamas purchases portfolio of Islamic financings from the seller institution on a without recourse basis:-

- Cagamas purchases Islamic financing originated by Islamic financial institutions, Government or selected corporations on a without recourse basis

- The beneficial title of the Islamic financing assets are transferred and assigned to Cagamas with the legal title remaining with the seller institutions (Originator) while Cagamas carries the assets on its book without recourse for default risk.

- The Islamic financings are purchased at their book value, i.e., the principal balance outstanding on a date which is closest to the purchase date but not earlier than the end of the month preceding the purchase date

- The Originator is appointed as a servicer to service and administer the Islamic financings on behalf of Cagamas. Its servicer functions, would amongst others include, collection and remittance of the payments made by the customers to Cagamas, in return for a servicer fee as agreed with Cagamas.

- The purchase mechanism is either under Bai’ al-Dayn al-Sila’ii (purchase of debts with commodities) or under Bai’ al-A’ayaan (purchase of the tangible assets) with cash, depending on the underlying Shariah contracts of the originated financings.

Key Features

- Outright sale to Cagamas, no recourse for default risk

- Standardized structure and documentation

- Pricing from par to premium, depending on quality of assets

- Cash purchase and/or settlement by way of issuance of Cagamas Sukuk to the Originator

- Originator will be appointed as the servicer and administrator of the financings sold

- Customers’ dealings of their financing accounts with the Originator are not affected

Benefits

- Transfer of credit and profit rate risks

- Manage portfolio concentration risk

- Reduce maturity mismatch

- Full capital relief

- Improve ROA and RWCR

- Fast turnaround time

- Competitive pricing

- Improve earnings stability